How Do I Register An Organization As A 501c3

Y'all have an issue yous feel passionately well-nigh. You've identified an unmet need and determined an organizational solution. Yous have created your mission statement and recruited others who care almost this outcome to brand a delivery to serve on your Board of Directors. You're at present hoping to interview employees and volunteers, besides equally raise funds to back up your cause.

Your soon-to-be-incorporated nonprofit is ready to launch and is fix for official nonprofit status from the federal government. But you're faced with the question: practise I file as a 501(c)(iii) nonprofit or 501(c)(4)?

What is the difference betwixt the two? While certain aspects of these filings are similar, there are key differences to take into consideration prior to applying. Your determination will alter the future of your organization.

What is the exact deviation between a 501(c)(3) and 501(c)(4)?

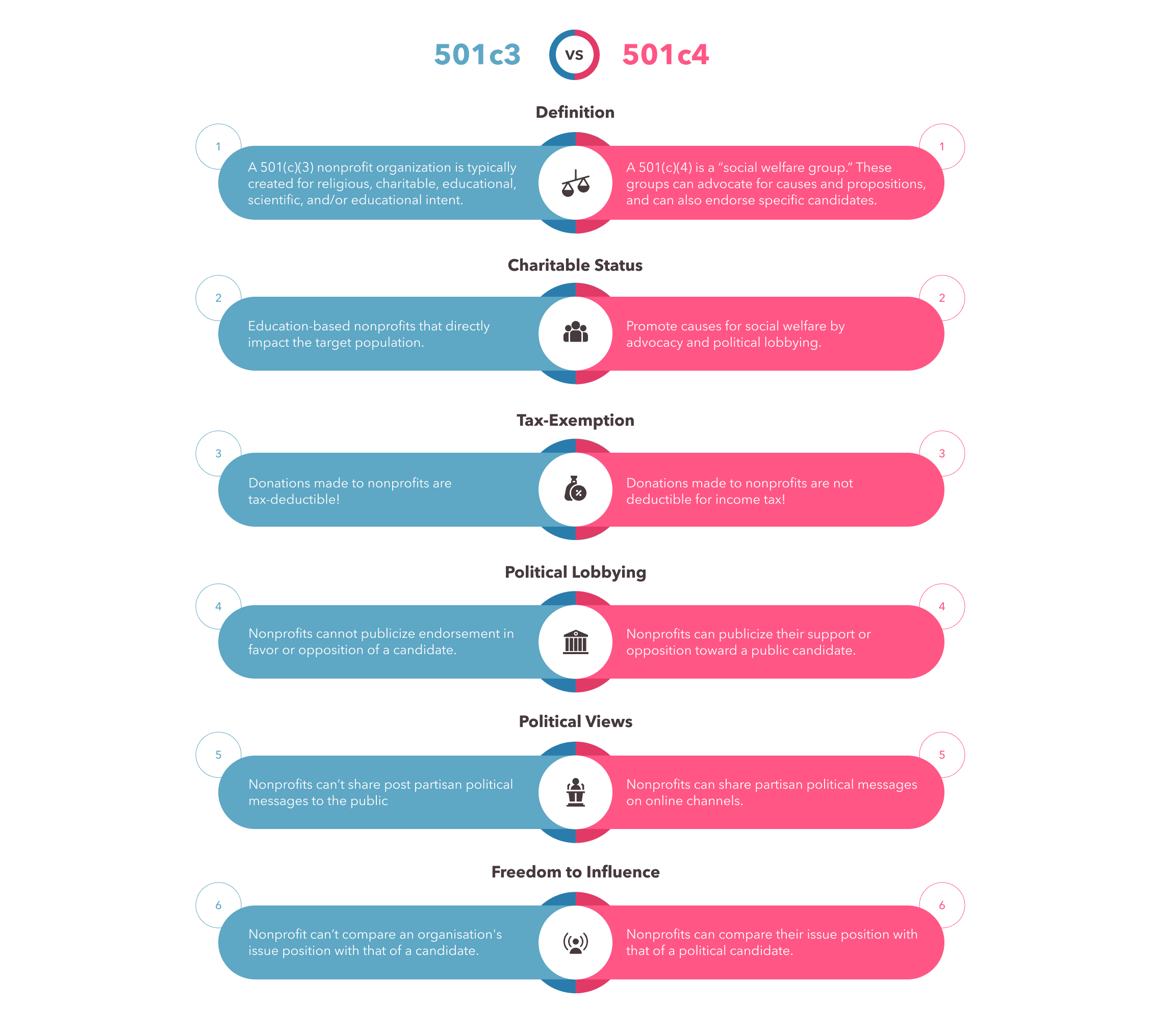

As per IRS, 501(c)3 is a nonprofit arrangement for religious, charitable, scientific, and educational purposes. Donations to 501(c)iii are tax-deductible. Whereas on the other paw, 501(c)4 is a social welfare group, and donations to 501(c)4 are non tax-deductible.

Let'southward understand 501(c)(3) and 501(c)(four) in more detail beneath:

What'southward a 501(c)(3)?

The Definition:

A 501(c)(3) nonprofit organization is typically created for religious, charitable, educational, scientific, and/or educational intent. They are revenue enhancement-exempt, bear inquiry, and are limited to an corporeality of lobbying, advocacy, or political activity. Donations to 501(c)(3) organizations are tax-deductible. Churches, cancer enquiry and back up groups, women'southward shelters, and mentoring programs for at-adventure youth are examples of 501(c)(3)groups.

What'southward a 501(c)(4)?

The Definition:

A 501(c)(4) is a "social welfare grouping" that can advocate for causes and propositions, like 501(c)(3)southward. However, 501(c)(4)s can also endorse specific candidates – one of the nearly substantial differences between the two. Examples of this status include political activeness groups to advance reproductive or ceremonious rights. While nonprofit organizations with this status are besides tax-exempt, donations to 501(c)(4) groups are not tax-deductible.

An In-Depth Look

Charitable vs. Social Welfare Purposes

501(c)(3)s are advocacy and education-based. They often provide straight services to their target population. The types of services provided are broad and various, including food distribution through food banks, medical research, after-school programs, health clinics, and mental health services.

These organizations enhance public awareness about their causes, and may even teach and railroad train the public near them. They can push forward and endorse legal measures such as propositions so long every bit they're relevant to the nonprofit's purpose.

Similar to 501(c)(3)s, 501(c)(four)s are considered social welfare organizations. They are tax-exempt from federal income taxes and aim to push their mission to the forefront of the public's consciousness. 501(c)(4)s are immune to go far more politically involved and partisan than 501(c)(3) organizations.

Lobbying

If a nonprofit organization focused on addressing and ending racism learns that there is a candidate whose platform undermines their mission, their power to address this will vary based on their federal nonprofit status.

501(c)(3)s can coordinate nonpartisan become-out-the-vote, voter registration, and teaching drives, as well every bit nonpartisan voter protection activities.

501(c)(4)s are unlimited in their abilities to anteroom for and against the legislation, as well as support and oppose election measures. In 2010, the Supreme Court ruled for the 2010 Citizens United conclusion, assuasive corporations and labor unions to annals as 501(c)(4)s, and therefore allow unlimited spending on politics with undisclosed donors through political action committees, or PACs.

Both 501(c)(3) organizations and those with 501(c)(4) status are able to advocate publicly for their causes, only considering 501(c)(4)s are allowed to lobby and advocate in means that 501(c)(3)s tin can't, 501(c)(4)due south have more than flexibility in advancing their bug. They tin can pay for costs necessary to a political organization, compare their own mission with a candidate'south, ask candidates to sign pledges on whatsoever consequence, and back candidates that reinforce their mission.

Political Entrada Intervention

As a 501(c)(3), the nonprofit tin host a debate between all candidates to bring their views on race and equality to calorie-free, but they cannot endorse their candidate of selection. Every bit a 501(c)(four), they would have the ability to endorse a candidate whose views align with their mission, support his or her entrada, and focus on getting out the vote efforts. However, donations to their cause – should information technology take 501(c)(iv) status – would non be tax-deductible.

Restrictions of 501(c)(three)s and 501(c)(4)s

501(c)(3)s cannot dictate which candidate receives which information—if they want to lobby, they must antechamber all interested candidates. The same goes for renting mailings lists and locations to organizations, legislators, and candidates – they must permit every candidate to rent, not just those they personally select.

Should these causes spread into the political realm, 501(c)(three)due south but have a limited ability to influence legislation and election measures. 501(c)(three)southward are non immune to endorse specific candidates. The nonprofits may also vocalization opinions of sitting elected officials, but they cannot make personal critiques of the individuals.

Similarities Between 501(c)(3)s and 501(c)(4)s

Sponsoring debates betwixt candidates regarding the nonprofit's field of study is allowed so long as all candidates are invited and given the opportunity to speak on the issues. 501(c)(3)s can also give voter guides to the public with comparisons between candidates on views of the nonprofit'south upshot should the candidate endorse or condone an consequence relevant to the 501(c)(3)s.

The nonprofits may also voice opinions of sitting elected officials, simply they cannot make personal critiques of the individuals.

Examples of 501(c)(3)south and 501(c)(4)s

Cystic Fibrosis Inquiry Inc. is a 501(c)(3) which endorses measures that are within the realm of their existing mission – for example, a state suggestion to advance stem cell enquiry. They do not endorse specific candidates – rather, they brainwash politicians on both sides of the political aisle to support legislation that will positively impact those living with cystic fibrosis and to vote against measures and bills that will harm or negatively bear on their constituents.

Bounding main Champions is a 501(c)(4) surround organization that has a political action committee (Ocean Champions PAC). They describe themselves as "the only ocean group that helps elect the Members of Congress who fight for our oceans." By supporting members of congress, they are utilizing their abilities as a 501(c)(4) organization to back up its mission

Can 501(c)(iii)south Take 501(c)(four)south?

Many groups have managed to provide direct services and advance their missions as a 501(c)(3) arrangement, while also advancing their mission through the political arena by establishing a separate 501(c)(four) organization that aligns with their mission.

One 501(c)(3) that also has an activeness fund is Planned Parenthood. While the organization itself is a nonprofit, advocating "for policy to aggrandize access to health care," the nonprofit also has an action fund arm: Planned Parenthood Action Fund (PPAF). Through this PPAF, Planned Parenthood is able to "fight to advance and expand access to … health care and defend reproductive rights," as their mission states.

Conclusion: Choose What'southward Best for You

Depending on your ultimate goal, comport in-depth research in club to make up one's mind which filing works best for you. Whether y'all're looking to endorse candidates or merely lobby on an issue relevant to your nonprofit, there is no wrong reply. Do your research, acknowledge your needs, and know that you're making a difference whether you lot're a 501(c)(3) or 501(c)(4).

As a nonprofit yous will demand funds in order to survive and operate, whether information technology is through grants, gifts, or donations- fundraising is an essential and continuous endeavor for any nonprofit.

Start maximizing your funds from the very beginning for your nonprofit by using effective and powerful tools and platforms similar Donorbox.

Find more nonprofit tips and resources at our nonprofit blog. If you're thinking to outset a nonprofit in the United states, we as well take dedicated articles for starting a nonprofit in different states in the US, including Texas, Minnesota, Oregon, Arizona, Illinois, and more.

Get Started With Donorbox

Frequently Asked Questions (FAQs)

This section will answer some common queries regarding 501(c)(3) and 501(c)(4) nonprofit organizations.

1. Can a 501(c)(3) organization change into a 501(c)(4) system?

A 501(c)(3) organisation cannot change into a 501(c)(4) organization. But information technology tin can deliquesce to create a new 501(c)(4) system. The dissolution clause may forbid the old nonprofit to distribute its assets to the new one, while still assuasive to make a grant with certain restrictions. Read more than about it here.

2. Does my 501(c)(iii) or 501(c)(4) nonprofit accept to disclose donors?

While filing course 990 returns, 501(c)(three) nonprofits need to disclose donor data for donations worth $5000 or more to the IRS. The private foundations under this status must also make their donor names bachelor for public inspection. On the other hand, 501(c)(4) nonprofits are exempt from whatever disclosure.

iii. Are donations to volunteer burn down companies taxation-deductible?

Volunteer fire companies are exempt every bit social welfare organizations when they actively engage in fire fighting and disaster assistance. Hence, donations made to their causes are tax-deductible, but they must be solely for the public benefit.

Annotation: By sharing this information we [Donorbox] do non intend to provide legal, revenue enhancement, or accounting advice, or to address specific situations. Please consult with your legal or taxation counselor to supplement and verify what yous learn here.

How Do I Register An Organization As A 501c3,

Source: https://donorbox.org/nonprofit-blog/501c3-vs-501c4

Posted by: mcgeecontaked.blogspot.com

0 Response to "How Do I Register An Organization As A 501c3"

Post a Comment